What interested me the most was how FinancialForce is symptomatic of an important evolution in the industry’s widely used class of enterprise software.

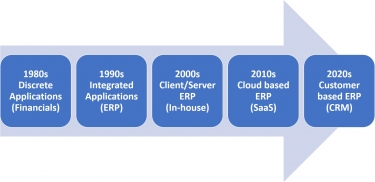

First, a bit of history. It’s now 30 years since the ERP revolution of the early 1990s, when an upstart German company called SAP virtually invented a whole new class of software.

ERP, which stands for enterprise resource planning, is the software at the core of any business. The term has come to include integrated financial applications such as accounts payable and receivable and a general ledger, and their integration with inventory and other applications like manufacturing or supply chain management, depending on the industry sector.

SAP introduced the concept of integration – bringing all these applications together into one suite – and in the process transformed the enterprise software industry in the 1990s.

Since then ERP has undergone many changes. After SAP a host of integrated ERP packages arrived on the market, but by the end of the decade vicious competition and rampant rationalisation saw most of them out of business or acquired. The top end of the market was dominated by SAP, which is still a major vendor today, and Oracle, which moved beyond databases to the application software market.

The buzzword back then was client/server software, a fancy word for mainframes and PCs sharing data. ERP was the ideal client/server application.

With the rise of the Internet in the late 1990s and into the new century ERP evolved further. There was a slow movement to the cloud, but many users resisted. In the early years cloud had performance issues and there were doubts about security. ERP is the most mission-critical of applications, and there was a strong feeling in the user community that it was one application that should remain in-house.

|

|

That is now changing. Performance and security doubts about cloud processing are dissipating. Many organisations are now moving core applications, including ERP, to the Software-as-a-Service (SaaS) model. A new breed of SaaS ERP vendors has emerged, and traditional vendors are offering cloud-based versions of the software – slowly and reluctantly in many cases.

Now FinancialForce is at the vanguard of another major change in the long evolution of ERP software. It is a SaaS based ERP package built on top of widely used CRM (customer relationship management) software Salesforce.com.

Salesforce was the first widely used SaaS package, launched at the end of the dot.com boom back in 1999. It was founded by ex-Oracle executive Marc Benioff, who is still its CEO today, with Oracle’s Larry Ellison an important early investor.

Salesforce pretty well pioneered the concept of Software-as-a-Service. In the two decades since it has become one of the largest and most successful software companies in the world, and has built an ecosystem called Force.com which enables other vendors to build applications that tie in with its CRM software.

This is the key to the evolution I’m talking about. Traditional ERP packages are based on invoices and inventory and receivables and payables. FinancialForce has built an ERP package that centres around customer information, which is the focus of the Salesforce.com platform.

It has become fashionable now for all software vendors to say their focus is on the customer. It’s an easy thing to say, but most are constrained by the underlying architecture of their product. This is particularly true of ERP, which is structured around transaction processing. Customer information is secondary data.

In the Salesforce.com ecosystem customer information is the primary data, with transactional and other information an adjunct to it. A CRM based ERP system such as FinancialForce is customer based by design. It represents the latest phase in the long evolution of ERP.

I’ve long been a student of ERP. I even once wrote a White Paper on the history of the technology. I’m convinced the customer centric focus of FinancialForce really does represent a new type of ERP. All this became apparent to me as I talked to CEO Tod Nielsen.

He was in Australia for the annual Salesforce.com Australian conference, usually one of Australia’s largest IT events, which was turned into an ‘online only’ event because of the Coronavirus scare. “I’m here already,” he told iTWire, “so now I can spend more time with our local people and our customers.”

He told me that FinancialForce has been around for ten years, but the message about customer centricity is only now really starting to resonate, since the release of its ERP software in 2014.

Before that the company specialised in Professional Services Automation (PSA), software for companies whose revenues come mostly from billable hours. “Now we offer full ERP, but still with the focus on how we interact with the customer.”

Nielsen joined the company three years ago from Salesforce to spearhead the growth into ERP. The company still remains closely associated with Salesforce, which was one of its original investors. “We’ve got lots of ex-Salesforce people – we’re very much part of the ecosystem. We were only the third company to build our software on the Salesforce platform – now there are nearly 6000.”

FinancialForce set up in Australia in 2015 and now has 30 local staff and 85 customers. Sydney is Asia-Pacific headquarters, under managing director Simon Peterson. It sells directly in Australia and through reseller and systems integrator Agilyx, which has become a significant partner in Australia and Asia.

“We are moving much more strongly into the enterprise space,” Nielsen told me. ”Our target market is organisations that have already implemented Salesforce. These are usually service-oriented businesses where our customer centric approach works best.”

When I interviewed Neilsen one of the company’s major new Australian customers was in the room. Novotech is a fast-growing contract research organisation which undertakes clinical trials for drug companies. It has recently signed with FinancialForce and is implementing a major application across its global operations. It is still based in Australia, with significant operations in Asia and North America.

Brad Campbell is Novotech’s CFO and is driving the FinancialForce implementation. “We’re growing very quickly and we’ve long been a big Salesforce user,” Campbell explained. “We undertook a substantial due diligence process and were happy that FinancialForce can do the job for us.

“We don’t want a front office and a back office – we just want one office. FinancialForce Will integrate all our operations and enable us to implement best practice across our organisation. It was important to us that it be cloud-based, secure, and customer oriented. That’s the way our business works.”

It is unusual for a vendor to expose a customer to the press at such an early stage of implementation. It is a strong endorsement. Novotech is one of Australia’s biotech success stories, acquired two years ago by US venture capital group TPG (no relation to the telco with the same initials) for an undisclosed figure believed to be in excess of $300 million.

FinancialForce has a number of other Australian companies in its sights. The ERP market continues to evolve, with a high degree of churn as organisations in many sectors look for competitive advantage. It’s growth rate indicates that, for many organisations, it might be the right type of ERP at the right time.

And it helps to be on the right side of history.